Bankruptcy Exemptions May Include Which of the Following

The Homestead Exemption in Bankruptcy. Money owed to utility companies.

An amount of equity in a vehicle wedding rings.

. Social Security unemployment benefits 401 disability benefits veteran benefits etc are all protected by federal law. Any post-bankruptcy earnings are completely exempt in a Chapter 7 filing. All of the above are exempt under the federal exemptions.

Specific Types of Exemptions. The Motor Vehicle Exemption in Bankruptcy. In addition to wildcard exemptions federal nonbankruptcy exemptions may be available to help you.

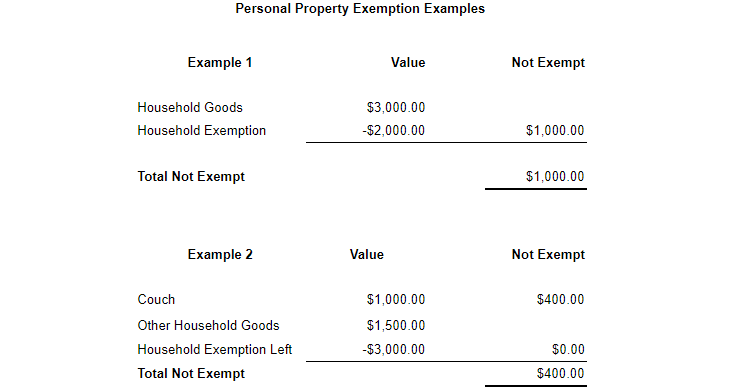

Pay you the 2000 exemption amount. Specific Types of Exemptions. Chapter 13 Bankruptcy Exemptions.

The debtor may exempt 25150 in value in real property or personal property that the debtor or a dependent of the debtor uses as a residence in a cooperative that owns property the debtor or a dependent uses as a residence or in a burial plot for the. Debtor may optionally use the federal bankruptcy exemptions if that state is any of the following which have not opted out of the federal exemptions. A homestead of any value.

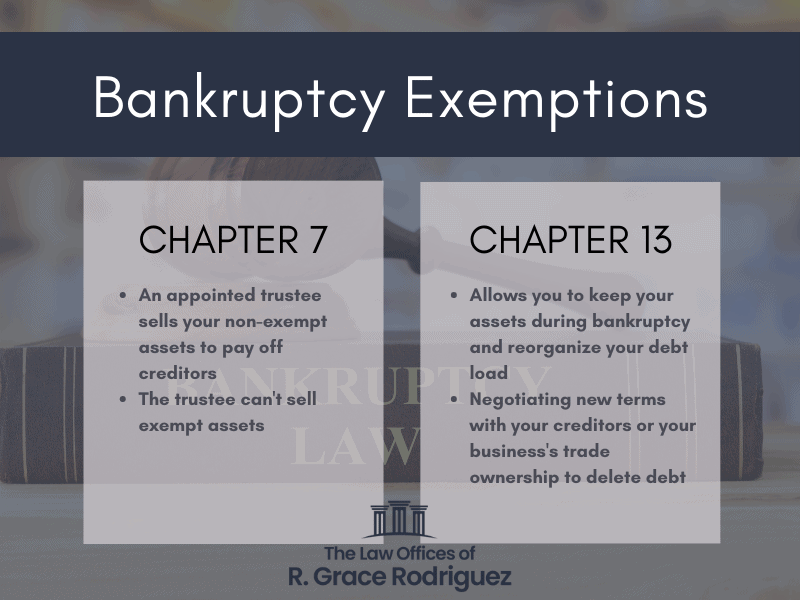

In this article well look at the seven most common types of bankruptcy exemptions and how they protect the filers property in a Chapter 7 bankruptcy. These specialty exemptions are available to anyone filing through their state but theyre harder to snag. Under the exemptions found in the federal Bankruptcy Code which of the following items may the debtor keep.

Which provides the following in pertinent part. Debts that cannot be discharged in bankruptcy include all EXCEPT a. Non-Exempt Property in Bankruptcy.

That property is the debtors exempt property. By todays living standards these exemptions are virtually non-existent. Each individual who files bankruptcy gets to keep basic assets deemed necessary for the debtors fresh start after bankruptcy.

Cash in the bank of 3000. Their contradictory name comes because theyre not part of the Bankruptcy Code. Bankruptcy exemptions may include which of the following Ahomestead home equity up to 21625 BJewelry up to 10000 CTools of trade up to.

The Wildcard Exemption in Bankruptcy. Most exemption schemes let the debtor protect the following. The amounts deposited must fall within the limits provided in the internal revenue code and benefit a child or grandchild.

Two of the above b and c. Currently the federal bankruptcy exemptions only apply if you live in one of the following states. The federal bankruptcy exemption list and the states exemption list.

Personal injury and crime victim awards. An ERISA-qualified retirement account. Chapter 7 bankruptcy is available to both individuals and businesses.

If no objections are filed to those. Any property that you can fully exempt in Chapter 7 bankruptcy will be immune to liquidation. Alaska Arkansas Connecticut District of Columbia Hawaii Kentucky Massachusetts Michigan Minnesota New Hampshire New Jersey.

Chapter 7 Bankruptcy Exemptions. Federal nonbankruptcy exemptions are still bankruptcy exemptions. Once complete the filer will receive a complete discharge from the dischargeable debts based on the courts decision.

Some state exemptions and the federal bankruptcy exemptions even include whats called a wildcard exemption. The homestead exemption in bankruptcy protects your home equity from creditors in a Chapter 7 bankruptcy and helps reduce your payments in a Chapter 13 bankruptcy. If however your state only allows a 2000 car exemption then the trustee could sell your car and do the following with the proceeds.

A wildcard exemption can be used to protect property thats not covered by another exemption. Income taxes for 3 years prior to filing. The funds must have been deposited into the account at least 365 days before bankruptcy filing.

Federal bankruptcy law also includes that you may exempt your retirement funds. Pay the lender 5000. This is the price you pay to have a certain amount of what you owe discharged.

New Jersey state bankruptcy exemptions include Household goods and clothing up to a total of 1000 a portion of a persons wages and retirement savings and pensions. Welfare benefits and retirement accounts are almost always protected but only if you list them on your paperwork. Nonexempt property on the other hand will be sold by your case trustee to pay off your unsecured debts.

Because the bankruptcy exemption would protect all vehicle equity the bankruptcy trustee would not sell the car. As youve read in Chapter 7 bankruptcies some items and property may be liquidated in order to pay the creditors. Money owed for alimony.

Other exemptions include the __ of the debtors trade and __ such as wheelchairs or glasses. The debtor also may keep up to a certain dollar amount in a __ and in __ goods such as furniture and clothing. Alaska Arkansas Connecticut the District of Columbia Hawaii Kentucky Massachusetts Michigan Minnesota New Hampshire New Jersey New Mexico New York Oregon Pennsylvania Rhode Island Texas Vermont Washington and Wisconsin.

The debtor claims property as exempt in the schedules that are filed to initiate the case. Retirement funds that do not exceed 1283025 may be exempt when a debtor files for bankruptcy. If you have this.

Personal Property Exemptions Personal property is any property that you can touch and that isnt physically attached to your house or land thats called real property. For instance a married couple may be able to exempt up to 47350 in home equity and up to 7550 for their vehicle. Some states permit residents to choose between two exemption schemes.

Some equity in a residential home and. 10000 per month in payments from a pension plan. Essentially bankruptcy law makes sure that your basic stuff is protected.

The __ exemption allows for the residence and burial plot of the debtor to be exempt up to a certain dollar amount. Chapter 7 Bankruptcy Exemptions. The only other funds covered under bankruptcy exemptions are educational retirement accounts or qualified state tuition programs.

The Homestead Exemption in Bankruptcy.

Bankruptcy Exemptions An Overview The Law Offices Of R Grace Rodriguez

Overview Of The 7 Most Commonly Used Bankruptcy Exemptions

Bankruptcy Exemptions What Assets Are Exempt In Chapter 7 13

Comments

Post a Comment